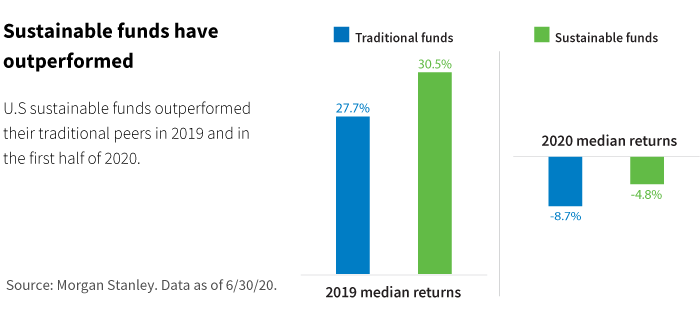

The challenges of 2020 have given us an opportunity to test our processes and performance in an extreme set of conditions. During this time, sustainable investing strategies have fared well, as has our active investment approach. We believe that active, fundamental research is key to unlocking differentiated insights and creating alpha for all strategies. The potential benefits are even more clear for sustainable investing, where underlying environmental, social, and governance (ESG) data is still evolving, and context matters greatly.

We seek out companies where a leading sustainability strategy is fueling financial outperformance.

Focus on inclusion is key to alpha and impact

As active managers, we take an inclusionary approach and seek out companies where a leading sustainability strategy is fueling financial outperformance. One example is First Republic Bank, where a strong culture leads to lower employee turnover, higher referral rates, and more sustainable loan growth.

Within the sustainable investment landscape, many passive strategies take an exclusionary approach that eliminates exposure to certain types of businesses, while other passive strategies take a “best-in-class” approach that aims for sector-neutral portfolio construction by owning stocks with the highest sustainability ratings within each sector or industry. For example, one of the largest passive ESG exchange-traded funds (ETFs) available today holds shares in Exxon and Chevron, two of the world’s largest publicly traded hydrocarbon producers. Several of the other top passive ESG ETFs hold shares in other large global hydrocarbon producers such as Saudi Arabian Oil Company, NK Lukoil, and others. This is because the investment process for passive ETF portfolios is typically based on excluding certain business involvements and incorporating assessments of ESG practices.

In contrast, our forward-looking fundamental approach, focused on long-term trends and company-specific business analysis, helped us to identify companies like AES, a global power company proactively transitioning power generation from hydrocarbons to renewable energy. The stocks of large hydrocarbon producers have underperformed in recent years in part due to the industry’s transition to lower cost renewable energy sources, whereas AES stock had a one-year gain of more than 19% as of August 31, 2020. Of course, an active approach does not always lead to such divergence in performance, but this example illustrates the potential benefit of investing in companies that are leading sustainability trends like the shift to renewable energy.

Considering companies of all sizes

As active managers, we sometimes seek opportunities in smaller, faster-growth companies that are creating innovative and impactful solutions. Many passive strategies rely at least in part on third-party ESG ratings, which tend to favor larger-cap companies. Larger companies have more resources to devote to ESG disclosure, which tends to lead to higher scores. Smaller companies with fewer resources, yet with products or services that might be tied to powerful sustainability themes, often have lower, or incomplete, scores from third-party data providers.

This dynamic can also be seen with newer companies, and especially with recent IPOs. Our ability as active managers to incorporate timely and unstructured ESG information before it is reflected in third-party scores is essential. Without this approach, our shareholders might miss out on the potentially strong performance of smaller or newly public companies that focus on sustainability solutions.

We learn from the past, but are focused on the future

A company’s disclosure on greenhouse gas emissions over the past five years is likely not the determining factor for financial performance (or environmental progress) over the next five years. Our approach allows us to use valuable historical and external ESG data as context for considering future prospects.

With an understanding of history, we can analyze future potential in areas like commitment to improvements in resource intensity, strength of corporate culture, and ability to invest future cash flows wisely. All of these elements are harder-to-quantify, forward-looking ESG characteristics that are not easily captured by third-party data, but can meaningfully impact future fundamental performance.

We analyze harder-to-quantify, forward-looking ESG characteristics that are not easily captured by third-party data, but can impact future performance.

We believe that thoughtful fundamental analysis is required to identify the relevant and financially material sustainability issues that will impact the future performance of a given company. By taking an integrated fundamental approach to research, we identify companies where sustainability leadership and innovative solutions will contribute to long-term financial success. Our active portfolios therefore pursue excellence in financial performance that is intrinsically linked to excellence in sustainability performance.